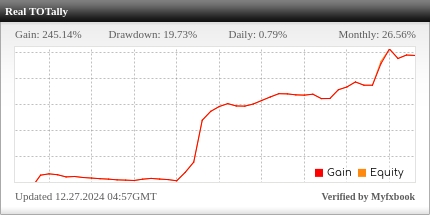

This is my real live account on MT4 trading the forex and CFD's.

This is a small acount and not anything like my main portfolio.

If you click on the chart it will take you to MyFXbook site., You will see that the account balance is way up but the gain % looks very strange.

The absolute gain cal is more representative.

The change is mainly due to using trading robots vs. my own manual trading. The robots just cant do it.

What's the secret? Wait. Wait for the right time. Don't trade when nothing is going on. There has to be movement.

Saturday, December 21, 2024

MT4 Real Account

Sunday, April 14, 2024

Ibanez EDC710 Bass Guitar Wiring Diagram

Here is a wiring diagram and photos of the inside of an Ibanez EDC710 bass guitar.

This bass has an after market pre-amp in it. Hope this helps you. There are no diagrams on the internet so I thought I would post this.

The orange on the diagram are the printed circuit board traces.The squares are the switch terminals.

I also marked a + and - on the diagram and you can ignore that.

Tuesday, May 16, 2023

Anchored VWAP

Introduction

Are you ready to take your trading game to the next level? Look no further than Anchored Volume Weighted Average Price (AVWAP), the most powerful technical analysis tool available for traders of all levels. Whether you’re an experienced trader or just starting out, AVWAP can help you make more informed trading decisions by providing an objective measurement of supply and demand for a specific security.

In this article, we’ll show you how to use AVWAP effectively and provide real-world examples of how traders have used it to make profitable trades. You’ll learn how AVWAP combines price, volume, and time to give you a better understanding of the emergent sentiment of a security from that moment forward. We’ll also show you how to analyze AVWAP across multiple timeframes and use it as a stop-loss strategy.

The AVWAP has become increasingly popular among traders, especially those engaged in intraday trading. The AVWAP is a modification of the Volume Weighted Average Price (VWAP) indicator that incorporates a price bar or anchor point chosen by the trader. This provides a more objective measurement of supply and demand for a specific security, regardless of your level of experience in trading.

One of the most important advantages of the AVWAP is its ability to combine price, volume, and time to give you a better understanding of the emergent sentiment of a security from that moment forward. Whether you are an experienced trader who prefers to analyze price action over a longer period of time or a new trader focused on short-term trading, the AVWAP is a versatile tool that can be used effectively on any timeframe.

As you use the AVWAP to analyze the trend of a security, you'll want to pay close attention to the direction and slope of the indicator, as well as how far above or below price action is in relation to the AVWAP. This can provide valuable insights into whether a security is overbought or oversold, helping you identify potential trading opportunities.

VWAP vs AVWAP

VWAP is Volume Weighted Average Price

AVWAP is Anchored Volume Weighted Average Price

If you're new to trading, you may have heard about VWAP and AVWAP and wondered what the differences are. Essentially, VWAP is a calculation that provides an average price of a security based on its volume throughout the day. In contrast, AVWAP is a modified version of VWAP that allows traders to anchor the calculation to a specific price bar, giving them a more objective measurement of supply and demand at a specific point in time.

The VWAP is widely used by institutional traders to assess market trends and determine optimal entry and exit points. It is an ongoing calculation that is updated throughout the day, and it serves as a benchmark for institutional traders.

On the other hand, AVWAP gives traders more flexibility and versatility by allowing them to anchor the calculation to any visible price bar. The AVWAP continues from the anchored point to the right side of the chart, making it a powerful tool for traders who want to analyze the market trend from a specific point in time.

While both indicators can be used to identify areas of support and resistance on the chart, the AVWAP can provide a more accurate measure since it considers a specific point in time. Traders can use both VWAP and AVWAP to determine potential entry and exit points, as well as to set stop-loss orders.

AVWAP formula

The formula for Anchored VWAP is as follows:

VWAP = (Sum of (Price x Volume) for the Anchored period) / (Sum of Volume for the anchored period)

To calculate Anchored VWAP, the trader must first determine the time period over which the VWAP will be calculated. This time period is known as the anchored period.

Next, the trader must identify the anchor point, which is the specific time in the past that will serve as the reference point for the VWAP calculation.

The trader then calculates the total volume and total value of all trades that have occurred within the anchored period, starting from the anchor point.

Finally, the trader divides the total value by the total volume to arrive at the anchored VWAP. Anchored VWAP can be applied to various trading instruments, such as stocks, exchange-traded funds (ETFs), futures contracts, and options.

It is typically used on securities with high liquidity and volume, as these securities tend to have more reliable VWAP readings. However, it may not be suitable for symbols that do not have volume, such as an index or some forex pairs.

Anchored VWAP is best used during periods of high volume and volatility, as it helps to smooth out short-term price fluctuations and provide a clearer picture of the longer-term trend. However, it may not be as useful during periods of low volume and volatility, as the VWAP may not accurately reflect market sentiment.

Approaches

By anchoring the VWAP to a specific point in the past, traders can filter out short-term fluctuations and focus on the longer-term trend. In this way, the Anchored VWAP can be used in conjunction with important events, as well as for timing buy trades.

One of the approaches that traders can use when using Anchored VWAP in conjunction with important events is to anchor the VWAP to the time period surrounding the event.

For example, if the event is scheduled to take place at 2:00 pm, traders can anchor the VWAP to the time period from 1:00 pm to 3:00 pm. By doing this, they can gain a sense of how the security has been trading in the lead-up to the event, which may help them identify potential buying or selling opportunities.

Another approach is to use anchored VWAP as a reference point after the event has taken place. Traders can anchor the VWAP to the time period immediately following the event and use it as a way to assess how the market is reacting to the news. If the security is trading above the anchored VWAP, it may be a sign of bullish sentiment, while if it is trading below the anchored VWAP, it may be a sign of bearish sentiment.

For timing buy trades, one approach that traders can take is to buy near the anchored VWAP. Some traders may look for opportunities to buy a security when it is trading near its anchored VWAP. The idea is that the security may be undervalued if it is trading below the anchored VWAP, and therefore may have potential for price appreciation.

On the other hand, traders can also wait for the security to move above its anchored VWAP and then enter a buy trade. This can be seen as a sign of buying momentum, and may indicate that the security is starting to trend upwards.

Traders can also wait for the security to cross above its anchored VWAP and then enter a buy trade. This can be seen as a bullish signal and may indicate that the security is breaking out of a sideways trading range.

It's important to note that these are just a few examples, and there are many other ways that anchored VWAP can be used in trading.

Traders can also use the direction and slope of the AVWAP to identify the trend of the security. If the AVWAP is sloping upwards, it can indicate that the security is in an uptrend, while a downward sloping AVWAP can indicate a downtrend. Traders can use this information to identify potential entry and exit points in the market.

Moreover, traders can use the distance between the security's price action and the AVWAP to identify potential support and resistance levels. If the price is trading above the AVWAP, it can indicate that there is support for the security at that level, while trading below the AVWAP can indicate resistance.

By using the AVWAP in conjunction with other technical analysis tools, such as trendlines and moving averages, traders can identify key levels in the market and make informed trading decisions.

Another approach is to use the AVWAP on multiple timeframes. The AVWAP can be used on any timeframe and is actually best used on multiple timeframes. By analyzing the AVWAP on different timeframes, traders can get a better understanding of the long-term trend of the security and identify potential trading opportunities. For example, if the AVWAP is sloping upwards on both the daily and weekly timeframe, it may indicate a strong uptrend, indicating that the security is in a longer-term uptrend.

Where to anchor

When it comes to anchoring VWAP, it's important to choose the right events to anchor from. These events should be significant and have the potential to impact the price of the security being traded.

One common anchor is the previous highs and lows in the chosen time frame. Anchoring from the previous swing high or low can provide traders with the average price that traders paid on the run-up, which can act as a support level when the price tries to go below it. Year-to-date, month-to-date, and week-to-date AVWAPs are also important anchors as they act as strong support and resistance levels. They show the average price that traders paid for their positions and traders tend to defend these levels.

Additionally, gap-ups and downs can also serve as great anchors since they represent significant price movements with a high level of market participation.

Earnings reports are another important event that can serve as an anchor for VWAP. Traders can anchor the VWAP from the day after earnings to track users who bought or shorted the stock after earnings. This can sometimes coincide with gap up and downs because they sometimes happen right after earnings.

Other events that traders may consider include economic releases, central bank meetings, political events, and natural disasters. Economic releases, such as GDP, employment figures, and inflation data, can have a major impact on financial markets, providing insight into the health of the economy and influencing central bank policy.

Central bank meetings can also indicate the direction of interest rates and other key economic indicators.

Political events and natural disasters can also disrupt economic activity and lead to price movements in financial markets.

Ultimately, the choice of anchor point will depend on the trader's individual trading strategy and the specific security being traded. By choosing the right anchor points, traders can gain insight into the average price paid by other market participants and use this information to make more informed trading decisions.

Using anchored VWAP as a reference point after the event

Using anchored VWAP as a reference point after an event can provide traders with valuable insight into market sentiment and potential trading opportunities. For example, let's say that a company announces better-than-expected earnings results, causing a surge in its stock price. A trader can anchor the VWAP to the time period immediately following the earnings announcement and use it as a reference point to assess how the market is reacting to the news.

If the stock price is trading above the anchored VWAP, it may indicate that there is bullish sentiment in the market, and the price is likely to continue its upward trend. Conversely, if the stock price is trading below the anchored VWAP, it may indicate that there is bearish sentiment in the market, and the price is likely to continue its downward trend.

Traders can use this information to make informed trading decisions, such as entering a long position if the stock is trading above the anchored VWAP and a short position if it is trading below it. They can also use the anchored VWAP as a reference point to set stop-loss orders or take-profit levels, based on the level of support or resistance provided by the VWAP.

Buying near anchored VWAP

Traders can also employ the anchored VWAP strategy by looking for buying opportunities when a security is trading close to its anchored VWAP. This strategy is based on the assumption that the security might be undervalued if its current price is below the anchored VWAP, which could indicate potential for price appreciation.

For instance, if a trader has anchored the VWAP to the start of the year and the security is trading in proximity to the anchored VWAP, they might consider this a favorable time to buy. By purchasing the security close to the anchored VWAP, traders can potentially benefit from undervaluation and position themselves for future price gains.

Buying when the security moves above anchored VWAP

An alternative method that traders can use with anchored VWAP is to wait for the security to surpass its anchored VWAP and then initiate a buy trade. The underlying idea behind this approach is that when a security is trading above its anchored VWAP, it may signal the start of an upward trend and present an opportunity for buying momentum.

For instance, suppose a trader has anchored the VWAP to the start of the current quarter and the security has recently crossed above the anchored VWAP. In that case, they may consider this a bullish indicator and enter a long position. By purchasing when the security surpasses the anchored VWAP, traders can capitalize on buying momentum and potentially profit from price appreciation.

Buying when the security crosses above the anchored VWAP

To potentially take advantage of a breakout, traders may wait for a security to cross above its anchored VWAP before entering a buy trade. This approach is based on the belief that a security crossing above its anchored VWAP is a bullish signal, indicating a potential breakout from a sideways trading range.

For instance, a trader could anchor the VWAP to an important news release and wait for the security to cross above the anchored VWAP before entering a long position. This way, they could potentially benefit from the breakout and position themselves for potential price appreciation.

When the direction changes

Throughout our analysis of the different anchors used with Anchored Volume Weighted Average Price (AVWAP), we have examined how the price tends to respond to them as either support or resistance levels. However, it is important to keep in mind that these levels are not always absolute and can sometimes fail to hold. Generally, it is often observed that these levels tend to break down when the AVWAP begins to flatten out.

This flattening of the AVWAP can indicate a shift in market sentiment and a potential change in direction of the security's price. As such, traders may want to consider adjusting their trading strategy accordingly, such as by moving stop-loss orders or re-evaluating their position. It is also important to note that while the AVWAP is a useful tool, it is not infallible, and traders should always be vigilant and incorporate a range of technical and fundamental analysis techniques into their trading decisions.

AVWAP as a stoploss

Anchored Volume Weighted Average Price (VWAP) is a versatile technical analysis tool that traders can use in multiple ways, including as a potential stop-loss strategy. Here are five examples of how traders can use anchored VWAP as a stop-loss strategy:

-

Setting a percentage below the anchored VWAP: As mentioned earlier,

traders can set a stop-loss order at a certain percentage below the

anchored VWAP. This can help limit potential losses if the security's

price starts to move against the trader.

-

Using multiple anchored VWAPs: Another approach is to use multiple

anchored VWAPs, each with a different time period, and set stop-loss

orders based on the distance between the current price and the anchored

VWAPs. This can provide a more comprehensive view of the security's

trend and help traders make more informed decisions.

-

Combining with other technical indicators: Traders can also use

anchored VWAP in combination with other technical indicators, such as

Relative Strength Index (RSI), Moving Average Convergence Divergence

(MACD), or Bollinger Bands, to set stop-loss orders. This can help

provide a more nuanced and accurate view of the security's trend and

potential risk.

-

Adjusting the stop-loss based on market volatility: Another approach is

to adjust the stop-loss based on the market's volatility. For instance,

traders can set a wider stop-loss in a more volatile market to avoid

getting stopped out too early or too frequently.

-

Using fundamental analysis: Finally, traders can also use fundamental

analysis to set stop-loss orders. By assessing a company's financial

health, business model, and industry trends, traders can determine the

appropriate level of risk and set stop-loss orders accordingly.

It's important to note that using anchored VWAP as a stop-loss strategy is just one possibility, and there are many other ways that stop-loss orders can be used. It's always a good idea to carefully consider your own investment objectives and risk tolerance before making any trading decisions. Additionally, it's important to keep in mind that stop-loss orders do not guarantee a certain price, and the security may be sold at a price that is different from the stop-loss price if the market moves quickly.

Statistical analysis techniques

Statistical analysis techniques are an essential tool for evaluating the performance of anchored volume weighted average price (VWAP). By incorporating statistical data into an analysis of anchored VWAP, traders can gain a more nuanced understanding of the indicator and how it is performing.

For example, mean reversion analysis is one statistical technique that can be used to analyze anchored VWAP. This involves comparing the security's current price to its anchored VWAP. If the security is trading above its anchored VWAP, it may be a sign that it is overvalued, and mean reversion analysis can assess the likelihood that the security's price will revert back towards the anchored VWAP.

Another statistical analysis technique is to evaluate the security's volatility. High volatility can increase the risk of trading, and the anchored VWAP may be less reliable as a reference point. On the other hand, if the security has low volatility, it may be less risky to trade and the anchored VWAP may be more reliable as a reference point.

Correlation is another approach used to evaluate anchored VWAP. By assessing the correlation between the security's price and its anchored VWAP, traders can determine whether the anchored VWAP is a reliable reference point. A strong correlation indicates that the anchored VWAP is a useful reference point, while a weak correlation suggests that the anchored VWAP is less reliable.

Traders can also use statistical measures such as the standard deviation and coefficient of variation to assess the reliability and stability of anchored VWAP. For instance, calculating the standard deviation of anchored VWAP over a specific time period can measure the dispersion of the data and assess the reliability of the indicator. Similarly, the coefficient of variation is a measure of the relative dispersion of a dataset that can provide a useful perspective on the stability of the indicator.

In addition to these statistical measures, traders can compare anchored VWAP to other indicators or benchmarks to assess its performance and usefulness in a particular trading strategy. For example, comparing anchored VWAP to the simple moving average (SMA) of a security can help traders determine how well the indicator is tracking the underlying trend.

It's essential to use a range of technical and fundamental analysis tools, including statistical analysis techniques, and to carefully consider your own investment objectives and risk tolerance before making any trading decisions. While these are just a few examples of statistical analysis techniques that can be used with anchored VWAP, there are many others that traders can explore. Incorporating statistical data into an analysis of anchored VWAP can provide a more comprehensive view of the indicator and help traders make more informed decisions about how to use it in their trading strategies.

Planning Trades with AVWAP

When utilizing the AVWAP indicator for trade planning, it is recommended to anchor it to significant events, such as the start of the year, day, or relevant highs/lows for your timeframe. The direction and slope of the AVWAP, as well as its distance from price movement, should also be considered.

If you're looking to initiate a buy trade, it is advisable to wait for a dip (pullback) and then buy into strength. To do so, start by determining the trend on a larger timeframe (e.g., uptrend on the daily chart, characterized by higher highs and higher lows). Anchor the AVWAP to the low of the trend's starting point and look for price touches, or handoffs, to determine the new anchor point.

Next, move to a lower timeframe and anchor the AVWAP to the most recent and relevant high and low. This will help identify who is in control of the price action or if the market is in a state of equilibrium. Look for price movement above the AVWAP from the high, while the AVWAP remains flat or rises, as this indicates that buyers are in control and presents a buying opportunity.

For stop placement, refer to the AVWAP from the recent low. When buyers are in control and stop losses are placed below the most recent or relevant lows, a setup is created. By following this approach, you can utilize the AVWAP indicator to help plan and execute trades effectively.

Example Trades

In the chart below of US500 (S&P500), the yellow vertical line represents

the opening of the day at 9:30 am EST. The red AVWAP is anchored to the momentum

bar, shortly after the open. As you can see, the AVWAP was defended during the

day's trading session, indicating that the buyers were in control. If you were

to consider entering on a pullback, you could wait for the AVWAP to be flat to

rising, with the price above it. Then, you could anchor an AVWAP to a recent

swing high and wait for the price to decline, then rise above the AVWAP to enter

the trade. Finally, you could anchor an AVWAP to the low that was just created

to use as a stop, using it as a guide to tell you which higher low is relevant

for stops.

The following chart showcases an example of how the AVWAP can be utilized to identify breakouts. Firstly, anchor the AVWAP to the recent swing high and low to establish a reference point. Observe how the AVWAPs begin to converge and move closer together, indicating an impending price movement. Once the price breaks above the recent highs and remains above the AVWAP, it signifies that buyers have taken charge. This is an opportune moment for traders to consider entering a long position.

Daily Chart Example

The chart below has 3 AVWAPs with numbers at important points.

1 - AVWAP anchored to the top. See how the downtrend pullbacks respect this line, you can use this to enter low risk trades.

2 - In a downtrend, you want to know when to enter for a short. Anchor to a bottom, when price cuts down thru its time to sell as sellers are in control.

3 - You can also anchor from where the momentum began, giving you an early warning where you can use a tighter stop.

4 - Once the down trending AVWAP was cut through upwards, it flattens out and price moves up. Above a flat to rising AVWAP at this point is telling you that buyers are in control.

Where can I get this indicator?

AVWAP can be used on a variety of trading platforms that support technical analysis and charting tools. However, it's important to note that the availability and functionality of AVWAP may vary between platforms. Additionally, as mentioned earlier, AVWAP may not be suitable for all types of trading instruments, such as those that don't have sufficient volume or liquidity. Therefore, it's important for traders to evaluate their trading needs and choose a platform that offers the appropriate tools for their specific trading strategy.

There are several other ways to access Anchored VWAP for MT4 or MT5, depending on your preferences and experience with the platform. Here are some options:

-

Download a third-party indicator: Many trading communities and websites

offer custom indicators for MT4, including Anchored VWAP. You can search

for "Anchored VWAP MT4 indicator" on your preferred search engine and

browse through the results to find a reliable source. Make sure to read

reviews and check the compatibility with your version of MT4 before

downloading and installing any indicator.

-

Code it yourself: If you have programming skills or access to a

developer, you can create your own Anchored VWAP indicator for MT4 using

the MQL4 language. The MQL4 Documentation provides a comprehensive guide

on how to code custom indicators and integrate them into the MT4

platform.

-

Hire a freelancer: If you don't feel comfortable coding yourself, you

can hire a freelance developer to create the Anchored VWAP indicator for

you. Websites like Upwork or Freelancer.com allow you to post a job

offer and receive bids from qualified developers. Make sure to specify

your requirements and budget clearly and choose a reputable freelancer

with good feedback.

Once you have the Anchored VWAP indicator installed on your MT4 platform, you can

use it to analyze the price action of your preferred trading instruments and

make informed trading decisions.Here is a partial list (at the time of writing) of Anchored VWAP indicators

available on mql5.com for both MT4 and MT5 platforms:

-

This is an indicator that I wrote and is available for purchase on MQL5.com for the MT4 platform:

Multi Anchored VWAP: This indicator automatically displays multiple

Anchored VWAPs (AVWAPs)

Additional Reading

Here are some suggested resources for further reading on anchored VWAP and its usage in technical analysis:

-

Investopedia: This website provides a comprehensive guide to anchored

VWAP, covering its calculation and application in trading.

-

StockCharts: This website offers a range of technical analysis tools,

including anchored VWAP. You can find a brief overview of the indicator

and how to use it in chart analysis.

-

TradingView: This social platform for traders and investors has a large

user community that shares their charts and analysis, including those

that use anchored VWAP. You can find a wealth of information on the

indicator by searching the platform's forums and blogs.

-

Online trading courses: Many online trading courses cover anchored VWAP

and other technical analysis indicators. These courses can provide a

deeper understanding of the indicator and its use in various trading

strategies.

Conclusion

In conclusion, the Anchored Volume Weighted Average Price (AVWAP) is a valuable tool for traders seeking to measure the average price of a security over a specific period, with the anchor point being a specified time in the past. It can be customized to fit the needs of individual traders and is best used during periods of high volume and volatility. While no indicator is perfect, the AVWAP provides valuable insights into the sentiment of the market or individual stocks by combining price, volume, and time. The Multi Anchored VWAP can be added to MT4 to help traders understand who is in control, buyers or sellers. Experimenting with various anchor points in targeted markets and stocks can help traders recognize the value of the AVWAP. Whether used as a stand-alone study or viewed with other indicators, the AVWAP is likely to become a favored tool in any trader's analysis and strategy.Friday, June 10, 2022

Anchored Volume Weighted Average Price (AVWAP) Indicator for MT4

Welcome to the Anchored Volume Weighted Average Price Indicator, also known as A-VWAP, AVWAP, Anchored VWAP.

Read more here

Intraday AVWAP

AVWAP from an event

How to Use VWAP - Volume Weighted Average Price from Brian Shannon - Alphatrends on Vimeo.

Saturday, June 4, 2022

Friday, July 30, 2021

SInce we began

This timer started counting on Tuesday July 29, 2016 at 18:00 EST. It is counting the days since we began.

Wednesday, April 15, 2020

Stockbee and Amibroker

Tipster Trendlines - Amibroker

Comment on this post....

Friday, January 17, 2020

Market - are you in or out?

IWM just ran up to a wall of supply. Apple is parabolic. Gold is moving. Not saying there is a crsh coming, just taking lots of profits off the table and waiting for a sale.

So if you hold stocks next week, I hope the market crashes on you and I will step in and buy all your shares

Thursday, January 16, 2020

Renko MT4 EA

Here's one that makes a great profit, check it out. This ins'nt a marketing scam, just real people making real EA's with hard work and dedication

https://www.bunkerforexforum.com/viewtopic.php?f=10&t=772

Thursday, December 26, 2019

NAS100

When to go flat

Use IWM chart, it's the only chart you need to see major market turning points

https://www.tradingview.com/chart/IWM/FhcK18Fr-When-to-go-flat/

We're still headed UP - we are in an uptrend. It DOES NOT MATTER WHY. Just buy the dips, put in your stops, and buy the next dip. As your trades increase in profit your marhin will also increase, so buy more. It snowballs.

Raise your stops - trail. When you are flat from stops, take a look at the bigger chart, the daily and 4 hour IWM. Plan your next move ahead of time.

I'm long NAS100 now, since it is at all time highs, I'm using IWM for direction.

Stay tuned

https://www.tradingview.com/chart/g6e1EeUT/

MT4 Info

Saturday, December 22, 2018

Market is going down?

Trade a reverse ETF or sell the ES futures.

Here is a chart that I'm following (by me) that you can take a look at.

Questions?

SPY headed DOWN DOWN DOWN by AnotherBrian on TradingView.com

Friday, October 26, 2018

UPRO

UPRO Chat Room

I day traded it twice and am liking it. Today I made more in 2 hours than I did all day at work.

I was inspired to use the "Active Trader" buttons in my Questrade IQ platform, by this guy in this video. I typically use limit order, even when daytrading and found it to be to time consuming. So after today, YES - this is my other method for very short trades.

If you day trade SPY or UPRO or any other of the SPY related ETF's, you should drop by the stock twits chat room and say hi.

Tuesday, October 23, 2018

Namaste

Buy at the the open, then sold. Shorted and covered at the bottom. Then buy, sold near the close. Was flat then open a small position for the overnight shock.

You can trade Namaste on the TSX as N.VN or the OTC as NXTTF

Come to this chat room to trade pot stocks. swing or day trade.

https://www.stocktwits.com/r/Namaste

Here are the trades for today

Pot Stocks

https://www.stocktwits.com/r/Namaste

We talk about stocks such as

- ABBV AbbVie Inc.

- TAP Molson Coors Brewing Company

- WEED.TO Canopy Growth Corporation

- TLRY Tilray, Inc.

- ACB.TO Aurora Cannabis Inc.

- CGC Canopy Growth Corporation

- ACBFF Aurora Cannabis Inc.

- GWPH GW Pharmaceuticals plc

- APH.TO Aphria Inc.

- SMG The Scotts Miracle-Gro Company

- CRON Cronos Group Inc.

- TRST.TO CannTrust Holdings Inc.

- TGOD.TO The Green Organic Dutchman Holdings Ltd.

- HYYDF HEXO Corp.

- TGODF The Green Organic Dutchman Holdings Ltd.

- CNTTF CannTrust Holdings Inc.

- CRBP Corbus Pharmaceuticals Holdings, Inc.

- NBEV New Age Beverages Corporation

- TRTC Terra Tech Corp.

- HYG.TO Hydrogenics Corporation CANN

- General Cannabis Corp MJ ETFMG Alternative Harvest ETF

- N.VN or NXXTF Namaste Technologies Inc.

- HEXO HEXO Corp

- Village Farms International (TSX:VFF)

- Cronos Group (TSX:CRON)

- Med Pharmaceuticals (TSX:IN)

- Canopy Growth (TSX:WEED)

Thursday, July 12, 2018

Wednesday, February 28, 2018

Tipster Trendlines New Home

Trade Forex!

If you are looking for Tipster Trendlines,

the famous MT4 EA has a new home.

Thursday, February 8, 2018

Use this amazing Expert Advisor to place your manual trades. The EA will manage the trades for you. Amazing sloped line trailing stop and tons more features!! Get it today while the price is still low low low!!

Get Tipster Trendiness Here - Before it's too late!

Monday, February 27, 2017

Thursday, November 17, 2016

Donald Trump - President Elect

So the question to you - How long do we wait until we can start to feel comfortable or start to panic?

Tuesday, November 15, 2016

Looking for a forex forum? - stay away from SteveHopwoodForex.com (SHF)

Steve likes to think he is a bully, a big fish in a small pond. It's humorous to read his words when you know he is an old man that teaches piano and "talks" to people like that.

I was banned before I could delete my membership. Left on my own terms. Copied all my important posts before I knowingly pissed off the old guy. I know he has a shit life, but the forum members are not his therapist.

If there are any members or ex members that share anything, this is the place.

Here is some posts from previous members of SHF on another forums that talk about this lunatic. These members have since joined bunkerforexforum.

Friday, November 11, 2016

Trump

- I am not surprised by Trump victory. I am not surprised by the campaigning words of any of the politicians. They say what they need to say to get votes - yes, it really is that simple.

- Thanks to CNN, the young generation are scared. A bad combination when you scare people with lots of energy.

- I called the win at 9:30pm - Trump was winning from the word go - the New York times probability meter confirmed what I was thinking using mathematical algo's. I also made some GREAT trades on election night trading NAS100 on MT4. I also made GREAT trades today as the market tanked the day after.

- I'm a white male, to special interest and minorities, please stop telling me that I will be OK forever and my life is easy. You don't even know me. The fact is that stupid or lazy or dangerous or illegal comes in all shapes, sizes and colours.

- Hollywood support - don't care. You are actors with lots of money. I don't share you issues. I typically vote the opposite of these people who are out of touch with the majority. And when these very passionate people don't get their Hilary elected they want to abandon the country and move to Canada. Label them greedy and selfish. Katy Perry says "the revolution will come"? Are you crazy, young people listen to you, professionals / adults shake their head.

- I have watched many specials (1 hour specials) that are directly related to my speciality field (that I will not share with you) and the media screws it up beyond recognition. Reporters went to school to write for the most part. They don't know anything about my profession and the topic they report on. The experts they had on the program were not experts, their expertise was somewhat related but not enough to make their knowledge meaningful. To many apparent experts and reporters are guessing. Are you guessing or do you know!!!!!

- What's up with this guy that says Trump victory is "White Lash"? Huh? Watching to much CNN buddy.

- First meeting of Trump and Obama - CNN seems surprised that they didn't call each other names, that they got along. WTF!!! They are professionals. They are very smart, smarter than you and I. Holy CNN crap. Imagine if the starter swinging, what do you think the public would do. Why did they meet 1 on 1? So they could talk without judgement and surprise. This is serious business.

- Trump didn't let reporters on his plane on his way to the first meeting - Good job Donald. Control the media.

- How long until Trump gets grey hair?

- Watch how trump changes his speeches now that he is elected.

- And the last thing I will say, to finish off this post is - Donald Trump will, at some point in his tenure, have the highest ratings of any president ever. I said it first.

Tuesday, March 8, 2016

Forex Forum

Saturday, February 27, 2016

Market Calls

For example, look at the market call on this web page

https://stockcharts.com/articles/chartwatchers/2012/11/a-bearish-bullish-percent-index.html

This guy couldn't have been any more wrong. "The market is breaking down" - then it took off 3 years!!

If these people lead a subscription based service, they should go back and delete pages when they are wrong, or stop posting market calls. Some of these people are apparent market experts! Hahaha!

Have you noticed any similar calls? Post them below in the comments!

Friday, December 25, 2015

MyFxBook Stats

Here's what I 'think' they mean...

Time Profitable: This is in pips but equivalent to the account currency, not pips of the trade.

Drawdown: In account currency pips, converter from the pair you traded

Risk:Reward:

Max:106.7 pips, This is the BEST watermark (high for buy, low for sell)

Min: -38.9 pips, This is the WORST watermark (worst DD in pips that the trade experienced)

Profit Missed: Closed price to high watermark

Entry Accuracy:

Exit Accuracy:

I look at the Min and Max numbers mostly to determine stop and target settings.

Tuesday, September 22, 2015

Tipster Trendlines Demo

Click the date to get the demo.

January 1, 2016

Friday, July 17, 2015

Tipster Trendlines DEMO

The only restrictions are;

- minimum lot size is used, you cannot change the lot size

- will work on demo accounts only (will not work on alive account)

- it will expire on date Aug 1 2015

Demo is on this page

Friday, May 22, 2015

Wednesday, May 20, 2015

Monday, March 23, 2015

Forex Volume

I did this post some time ago, and while re-reading it I realised that I don't use volume on MT4. Apart from it being inaccurate on the MT4 platform, it's not part of my strategy. MT4 volume uses the aggregate volume from the broker you use. So it tells you what retail traders are doing, not banks. I use price action and Tipster Trendlines to place the trades at supply and demand. Sam Seiden method of Trading Academy, I'm sure you've heard of him?

Monday, March 16, 2015

US OIL, CHF, and Russia

Ever since the end of the 2014 Winter Olympics when Russia made the move on Cremia, the big boys (world leaders) were not very happy.

After a while Russia's economy took a hit because of steps the rest of the world was taking (I'm not going into detail here). Trying to regulate money flow in/out of Russia, and other things.....

Then oil started to move. Russia exports lots of oil, something like 68% is oil. "We can make Russia feel some pain, let's lower the price of crude!"

This is a monthly chart of US OIL, in my MT4 platform where I use Tipster Trendlines to chart trade. You can see much of the same with the ETF UCO.

June 15 it started to decline, and Sept 28, 2014 it broke demand and went down hard to where we are today.

I wonder how much Putin has in Swiss banks? I wonder if the CHF currency jolt had anything to do with Russia or its leader? I can't really see why there is any relation but once almost never know (until 50 years later).

Thursday, March 5, 2015

Compound your profits

Those that become successful long term traders understand the power of compounding gains for huge eventual profits, they start small, aim low and believe it will all pay off in the future, however most human beings are born with a natural greed, an emotion that runs so strong in most people's veins that the thought of 2 - 3% a week sends shivers down their spine and they become part of the above club, the 95% of unsuccessful traders.

As fun as it is to dream of doubling your money every fortnight it is important to be realistic of what to expect in terms of profit in both the short and the long term, the reality is a consistent weekly gain of 2 - 3% over the period of a year is no easy feat for even the best of traders however it is achievable for the few successful traders.

To most the idea of making a 2 - 3% weekly gain isn't all that exciting, especially when compared to claims of 20,30 and even 40% returns a week that are often thrown around on the internet but the moment we add compounding into the equation those small weekly figures can amass to some huge yet realistic sums of money.

For those that don't understand the concept of compounding gains or interest it is the exponential growth of a sum of money by continuously reinvesting all profits, so although the profit percentage remains the same the actual sum of money grows at a very rapid rate.

As a very basic example lets assume we have $1000 in our trading account.

Total gain in percentage - 213.8%

Total gain in percentage - 299519.8%

How is that for a retirement plan? 7 year plan.

You can use this concept for your expert advisors as well. Set a weekly balance limit that will cut off the EA from trading until the next week. Also, set a profit target for your EA so it will close all positions or at least set stops to protect that profit. This is one way of controlling your EA's in MT4 so that they will achieve your goals.. It will also aid to get you out of the market when things start to change.